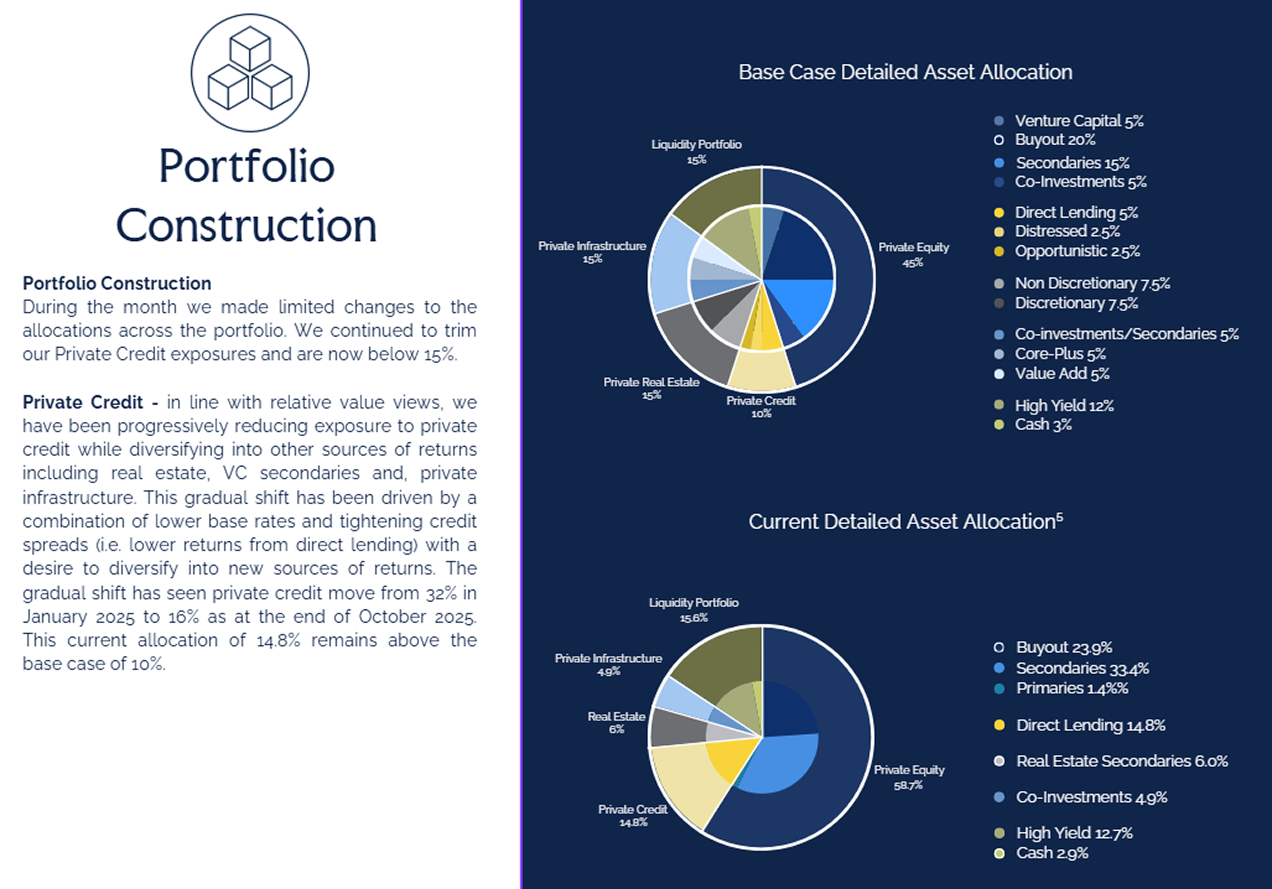

The Spire Global Private Markets Portfolio (Fund) seeks to return a net 10-13% per annum over rolling 7 year periods. The Fund is a multi-asset portfolio which provides exposure to private market investments, across private equity, private debt, private infrastructure and private real estate sectors. An allocation to cash and other tradable assets provides liquidity to efficiently trade, manage cash flows and fund new investments.

⁵Asset Allocation, Geographic Allocation, Investment Manager Allocation, and Current Detailed Asset Allocation charts all include ‘Planned Investments’ as at the end of the month. Planned Investments are applications that have been made and funded, but the Portfolio is yet to receive the units.

| Period | Distribution Amount (Cents per unit) | Ex Price | Distribution Components |

|---|---|---|---|

| 30 June 2025 | 1.1696 CPU Cash; Nil CPU FITOs | 1.1418 | Download File |

| 30 June 2024 | 1.1157 CPU Cash; Nil CPU FITO's | 1.0291 | Download File |

| Latest Monthly Report | Download File |

| Fact Sheet | Download File |

| Investor Pack | link |

| Product Disclosure Statement (PDS) | Download File |

| Target Market Determination (TMD) | Download File |

| Off Market Transfer Form | Download File |

How to invest

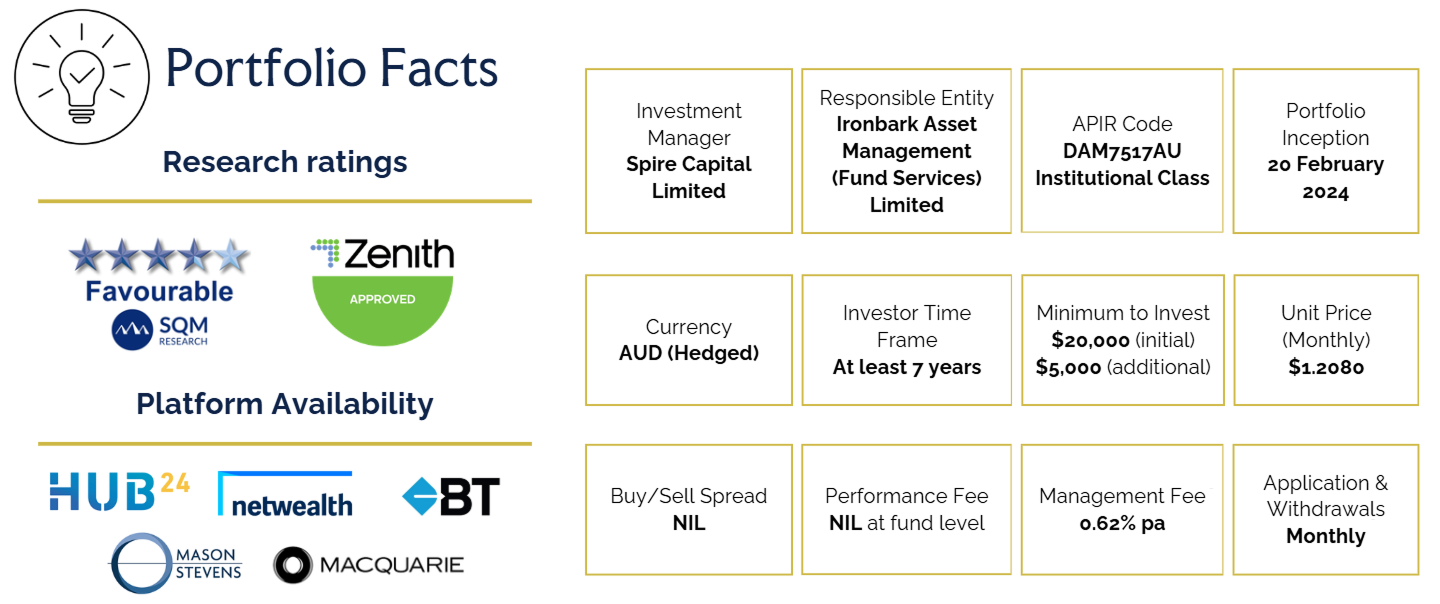

Via your financial adviser

Please reach out to your financial adviser for more information on Spire Capital and our investment offerings. Spire investments are available on a range of administration platforms including Netwealth, HUB24 and Mason Stevens.