About Us

Company Overview

Spire Capital is an independently owned private investment firm specialising in global private markets. The firm has been searching, sourcing, researching, structuring and investing in global private market investments since 2009 and has built a strong track-record spanning investments in private equity, venture capital, private debt, private infrastructure and private real estate. Led by research, Spire leverages a global network of proprietary relationships to identify and access premium private market funds, co-investments and direct secondary investments to execute investment views.

Spire Capital is proud to serve a large clientele of family offices, private wealth firms and high net worth individuals with over $2.25bn invested since inception. Depending on requirements, local investors can access a range of solutions including the flagship Spire Global Private Markets Portfolio and a curated list of wholesale investments spanning high conviction private equity funds and direct co-investments. Customised mandates are available for investors with AU$100m+.

Australian investors benefit from Spire’s extensive funds management experience to ensure global private market investments are customised to local tax, legal, administration, currency and reporting requirements. Spire’s national Investor Relations team provides local support for researching, onboarding and monitoring Spire investment opportunities.

Investing in private markets requires patience as value is created over the long term. Spire Capital is focused on investment results while recognising that transparency and relationships matter along the journey. Spire’s semi-annual Reporting Season provides interaction with key investment professionals as part of sharing progress of investments over the journey. Monthly and quarterly reporting provide additional insights while Spire’s local Investor Relations team serves client relationships with professionalism and care.

Investment proposition

Global private markets for local private wealth

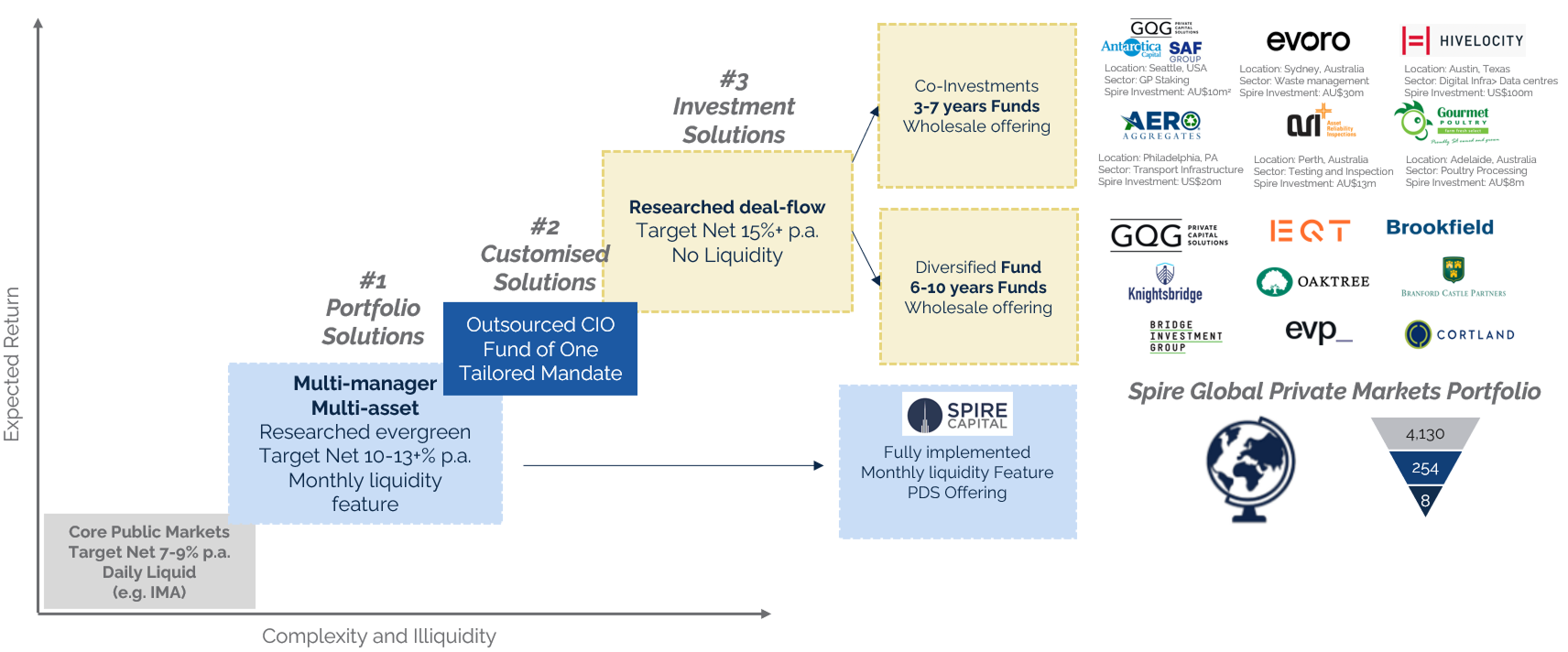

Spire has different private market investment offerings, for different client needs, that sit alongside traditional core, public market allocations.

Portfolio Solutions:

Fully implemented multi-manager private markets portfolio (PMP) designed to be suitable for investors seeking pan-private exposure and simple implementation.

Customised Solutions:

For larger investors who can commit $100m+, Spire can manage customised mandates and feeder funds

Investment Solutions:

Researched deal-flow for Australian Wholesale investors alongside world-class private equity firms. High conviction funds and co-investments. Feeder fund customised for Australian investors with low minimums (e.g. AU$100,000)

Our Team

A local team with a global perspective and experience

Spire is fortunate to have a highly experienced team spanning investment management, funds management, operations and investor relations. Building on decades of experience working around the world for quality institutions (e.g., Partners Group, Schroders, QIC, Macquarie Bank, MLC Asset Management), the team combines institutional discipline with a nimble approach to researching, structuring and managing investment opportunities across global private markets.

Matthew Cook

Founding Partner, Head of Funds Management

Dale Holmes

Partner, Regional Manager

Stuart Haigh

Partner, Head of Investments

Sam Hallinan

Managing Partner, Head of Investor Relations

Peeyush Gupta

Independent Chair, Spire Investment Committee

Richard Gregson

Independent Member, Spire Investment Committee

Scott Dingle

Investment Manager

Leakena Taing

Head of Operations

Franco Dagelet

Senior Associate, Investor Relations & Head of Technology

Chris Niall

Regional Manager - Investor Relations (VIC)

Lachlan Hay-Hendry

Regional Manager - Investor Relations (WA/SA)

Luke Mura

Senior Fund Accountant

Shane Harvey

Chief Financial Officer

Suzette Tenedora

Senior Fund Accountant

Nick Richmond

Senior Fund Accountant

Cybella Macindoe

Associate, Investor Relations

Rodney Bolton

Senior Investment Analyst

Agustin Gunawan

Senior Fund Accountant