Portfolio Solutions

Spire Capital Global Private Markets Portfolio

Spire Capital offers a fully implemented global private markets program spanning private equity, private debt, private infrastructure and private real estate. The flagship Spire Global Private Markets Portfolio (“Spire PMP”) is a multi-manager, multi-strategy approach to global private markets seeking to deliver net 10-13% p.a. over rolling 7-year periods with with monthly redemption features, lower volatility and lower correlation risk as compared to public makets.

The approach combines a ‘top-down’ quarterly global relative value assessment with a detailed ‘bottom-up’ asset class review to identifying the best managers on preferred terms with awareness of Australian taxation outcomes.

The multi-manager, multi-asset approach provides investors with a diversified exposure to private markets by allocating across sub-asset classes and leading investment managers. The approach combines an allocation to core evergreen strategies for diversification with an Opportunistic Portfolio which focuses on investments that combine an attractive long-term thesis with short term embedded value (e.g., direct secondaries and co-investments).

The Spire PMP also invests in cash, daily-liquid assets and associated funds (e.g., money-market funds, traded debt funds). These investments make up the Liquidity Portfolio, a sub-set of the investment strategy dedicated to meeting the liquidity requirements of the Spire PMP.

What are private markets?

Private markets are investments made into companies and securities that are not listed on public exchanges. Like public markets, you can invest into private markets via the four main asset classes, which include:

Private Equity

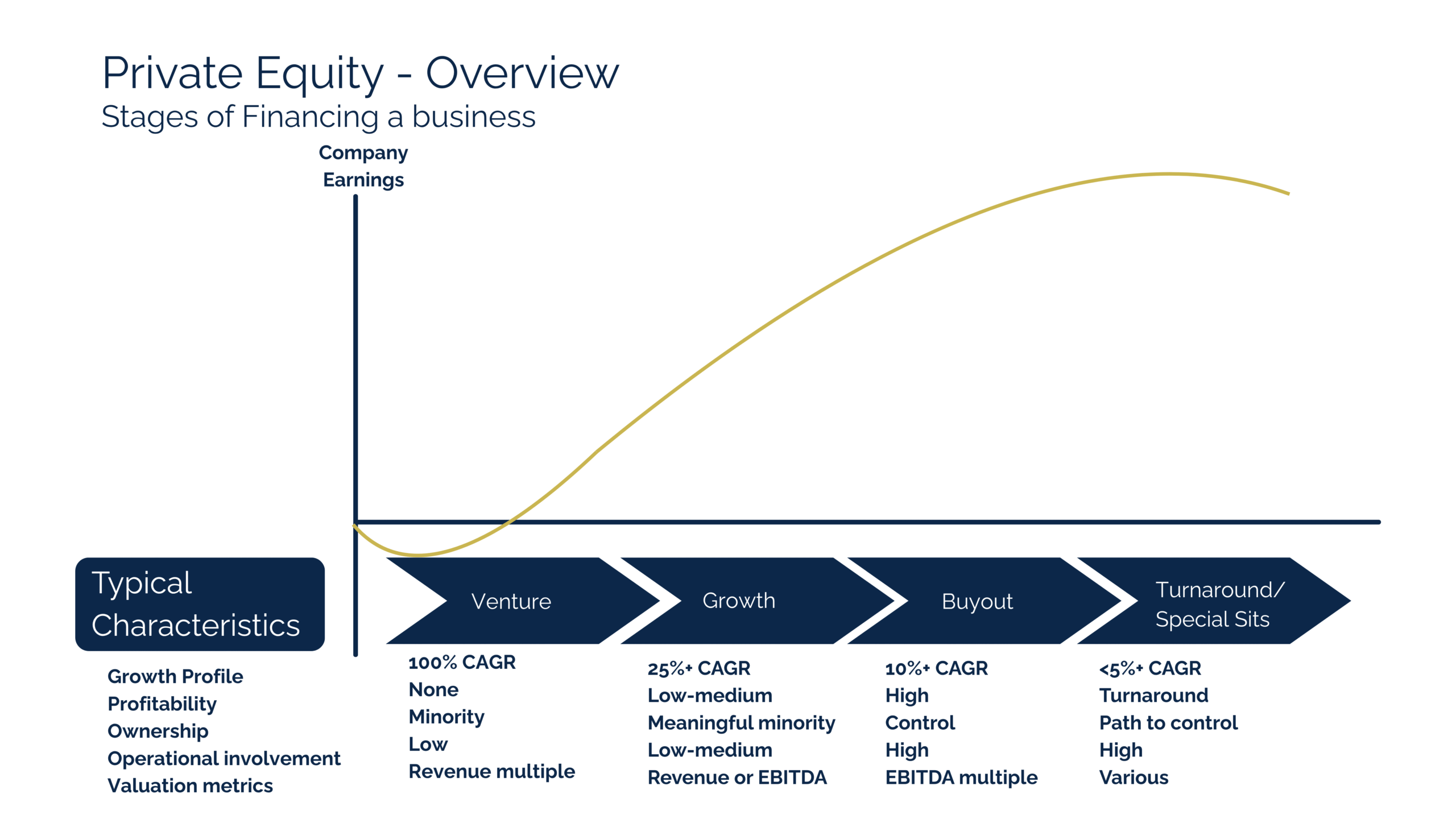

What is Private Equity?

Private equity (PE) represents direct investment in companies not listed on a stock exchange. Private equity managers (‘General Partners’ or GP’s) actively map and source attractive investment opportunities before spending several months performing due diligence and preparing value creation plans for target companies. Once a stake is taken, the GP draws on a value creation ‘playbook’ (including operational expertise, strategic repositioning, and financial optimisation) to help the company realise its potential over a 3-7 year holding period. GP’s then work through an orderly exit process which includes a broad range of prospective buyers across strategic, trade, other PE investors and an Initial Public Offering (IPO).

PE as a sub-asset class of private markets spans venture capital (backing startups), growth equity (accelerating expansion-stage companies), buyouts (enhancing established businesses) and turnarounds/special situations (rescuing or repairing bad balance sheets or companies not operating at full potential).

Private Real Estate

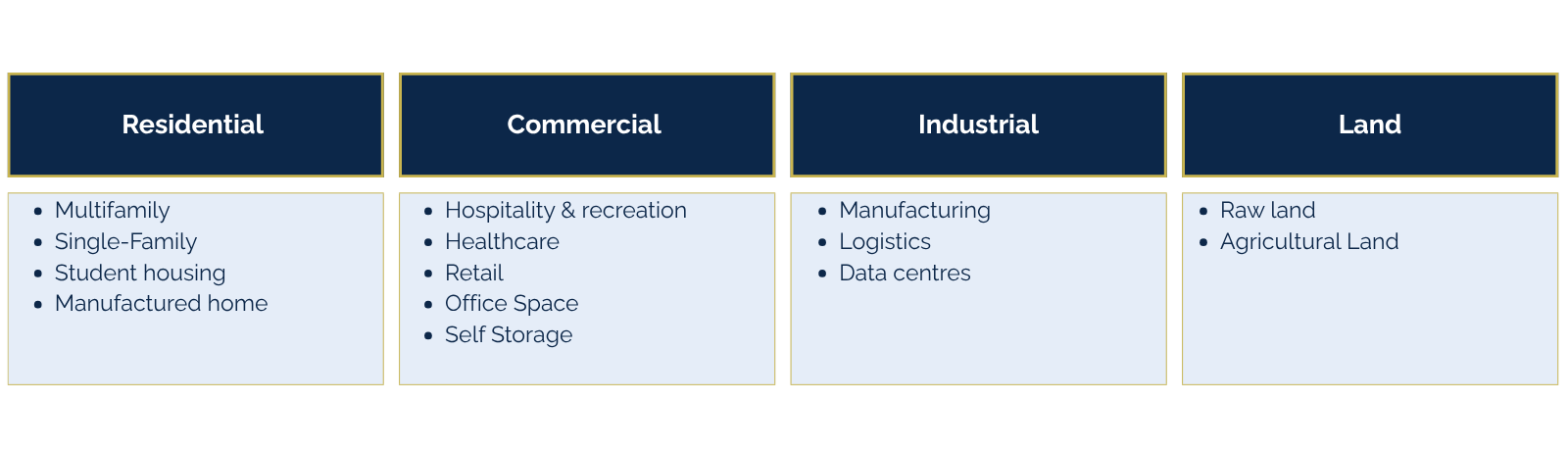

What is Private Real Estate?

Private real estate applies an ‘active ownership’ approach to real estate assets. This includes private real estate fund managers acquiring land or buildings (not traded on a stock exchange) with a plan to improve or renovate the assets and amenities. Private real estate investments stand in contrast to publicly traded REITs (Real Estate Investment Trusts). Private real estate typically includes land and buildings across a number of sectors (including residential, commercial, industrial and land) and investment strategies (core plus, value add and opportunistic).

Privat Debt

What is Private Debt?

Private Debt (or private credit) includes any debt held by or extended to privately held companies (“the borrower”). It comes in many forms, but most commonly involves non-bank institutions (“the lender”) making loans to private companies or buying those loans on the secondary market. Private debt fund managers raise and manage funds with a wide spectrum of underlying investment strategies. For example, some private debt funds provide capital to private equity-backed borrowers to fund acquisitions, others fund real estate development projects and some invest entirely in the debt of distressed companies.

Private Infrastructure

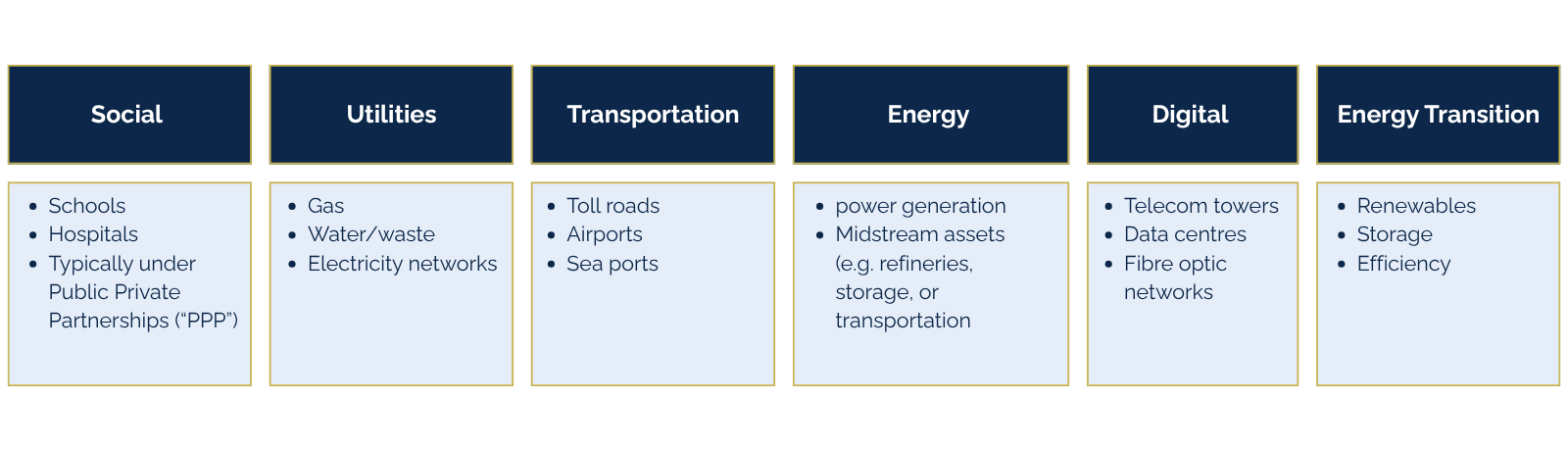

What is Private Infrastructure?

Private infrastructure applies an ‘active ownership’ approach to infrastructure assets and involves direct investment in essential physical assets and systems that underpin economic activity. Private infrastructure managers acquire stakes in utilities, transportation networks, digital/fibre networks, energy facilities, communication systems and social infrastructure with a view to leverage operational improvements, regulatory expertise and capital enhancement strategies to optimise assets. The typical hold period is 5-10 years with exits often to other infrastructure investors or strategic buyers.

The private infrastructure asset class spans greenfield development of new projects, brownfield enhancement of existing assets, and core infrastructure providing stable income streams—delivering attractive risk-adjusted returns through essential service provision.

Why consider private markets?

Annualised volatility and return, 1998-2025

Performance Outcomes

Private markets have historically delivered compelling performance outcomes for sophisticated investors. Top-quartile private market funds consistently outperform public market equivalents across economic cycles, generating alpha through operational improvements and strategic repositioning unavailable in passive investments. This advantage stems from several structural benefits: the illiquidity premium rewarding patient capital, information asymmetries creating mispricing opportunities, and direct value creation through operational control. Past performance is not a reliable indicator of future performance. Any investment is subject to investment risk, including possible delays on the payment of withdrawal proceeds and the loss of capital invested.

Source: Bloomberg, Burgiss, FactSet, NCREIF, PivotalPath, Standard & Poor’s, J.P. Morgan Asset Management.

Past performance is not a reliable indicator of future performance. Any investment is subject to investment risk, including possible delays on the payment of withdrawal proceeds and the loss of capital invested.

Source: Hamilton Lane, A Guide to the Private Markets

Public Markets vs Private Markets

Private markets represent a large and dynamic universe of companies and assets not traded on public exchanges. These investments are led by private equity fund managers (i.e., General Partners or GP’s) on behalf of their investors (Limited Partners or LP’s) with the view to helping target companies/assets to realise their potential. This ‘active ownership’ approach to investing is designed to deliver outsized earnings growth and returns for investors.

How to access, optimise and implement private markets

The Spire Global Private Markets Portfolio (‘Spire PMP’) offers retail clients with access to private markets investments via major Australian investment administration platforms that were traditionally only made available to institutions. An evergreen fund structure with a monthly liquidity feature (subject to restrictions including liquidity constraints of the fund, the underlying fund/s and the constitution) and allows for more efficient execution across multiple entities and clients over time. The scale of the Spire PMP enables investors to secure private markets investments for lower relative fees across a broad portfolio of investment managers and investment opportunities.

Our portfolio design approach takes into consideration a top down assessment of relative value across different asset classes, combined with thematic mega-themes, manager research and selection, and use of secondary funds to build a bespoke portfolio aiming to deliver 10% to 13% over 7 year periods. Refer to the Spire PMP Product Disclosure Statement (PDS) and Target Market Determination (TMD)

Global Relative Value - Top down asset allocation

The Spire PMP strategy applies a top-down framework to assess the relative attractiveness of private equity, private debt, private infrastructure and private real estate within parameters approved by the Investment Committee. This process, referred to as the quarterly Relative Value Analysis, draws on a range of inputs including asset class return data, volatility measures, correlations, capital flows, valuation indicators, financial metrics, economic forecasts and external research.

The analysis assists Spire in forming a view on prevailing conditions across private markets sectors and in determining how the Portfolio may be positioned within its existing investment guidelines. This process forms one component of the broader investment approach and does not guarantee improved performance or specific investment outcomes.

*This diagram is for illustrative purposes only

Thematic Sourcing - Finding the best areas to invest

Spire’s thematic approach to sourcing aligns with the firm’s prevailing investment views. The Spire Investment Team proactively searches, sources, researches and structures investments in line with 2 broad categories:

Strategic – capitalising on mega-themes and carefully targeted opportunities for investment (e.g., digital infrastructure, protein consumption)

Tactical – opportunistic investments to take advantage of a temporary market dislocation, mispricing or arbitrage opportunity (e.g., distressed debt and venture capital secondaries)

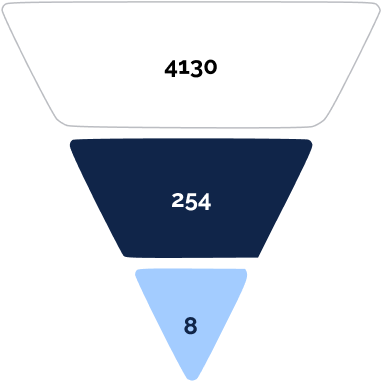

Spire Capital actively leverages its networks and rigorous screening processes to access enhanced deal flow. The firm’s highly experienced Investment Team pro-actively works with a broad range of sourcing channels including existing General Partners (over AU$2.25bn deployed as at Q4 2025), alumni networks (e.g. Partners Group, QIC, MLC Asset Management), fellow fund/co-investors (e.g. Goldman Sachs), prospective GP’s (over 250 actively monitored) and asset allocators.

Manager Selection - Choosing the most appropriate manager for execution

Manager Selection

The Spire Global Private Markets Portfolio benefits from our highly experienced investment team led by Stuart Haigh and Scott Dingle, who bring over 35 combined years of institutional private market expertise, including senior roles at Partners Group. Our investment committee includes independent industry veterans like Peeyush Gupta AM as Chair and Dr. Richard Gregson, ensuring sound governance risk-based perspectives and diligent evaluation of investment opportunities. This combination of global institutional experience and independent oversight drives our rigorous manager selection process, securing preferential terms typically unavailable to individual investors.

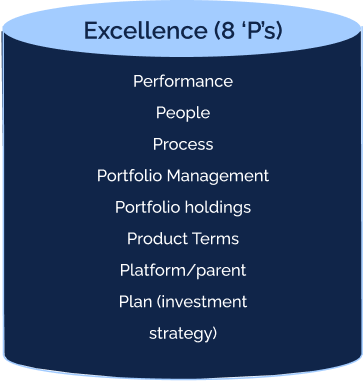

The screening criteria varies from asset class to asset class. A shortlist is determined and due diligence is performed in the Manager Assessment Model (“MAM”) in line with the 8 ‘P’s’, namely: Plan, People, Process, Platform, Performance, Portfolio, Portfolio Management and Product. Each of these areas are systematically assigned a rating based on the assessment of a number of undetlying inputs. These ratings are weighted to generate a combined rating for each of the portial undertlying managers to help assess their relative attractiveness.

Filter

Evaluate

Decide

Use of Secondaries to deliver superior risk adjusted returns

What are Secondaries?

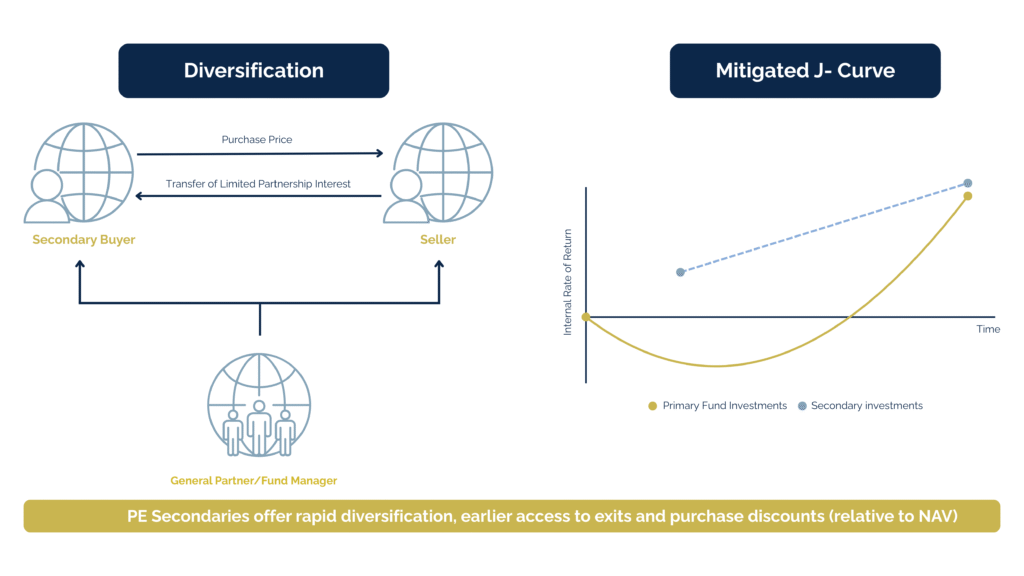

The secondary market refers to transactions in which investors buy and sell existing interests in private market funds. In these transactions, a purchaser acquires an interest that has already been partially or fully invested by the fund, rather than making a new (primary) commitment.

Secondary transactions generally provide greater visibility over the underlying portfolio because the assets are largely known at the time of acquisition. As a result, the level of “blind pool” exposure is typically reduced compared with primary fund commitments, where underlying investments are made over several years.

Primary private market funds often take between three and five years to deploy committed capital, and investors may not receive distributions until later in the fund’s life. Secondary transactions may lead to earlier distributions because the acquired interests are generally in more mature funds. This can reduce the early-stage return profile commonly referred to as the “J-curve”; however, outcomes will vary depending on the nature and performance of the underlying assets, prevailing market conditions and the terms of each transaction.

Secondary interests may provide broader diversification because they can relate to multiple funds or to funds with established portfolios of companies or assets. Diversification benefits are not assured, as they depend on the composition of the acquired interests and their underlying exposures.

Portfolio Construction - Aiming to deliver 10 - 13% over 7 year periods

Spire PMP features a multi-layer portfolio construction approach which balances core institutional funds with opportunistic investments and liquidity reserves. This design ‘seeks to deliver’ sustainable 10-13% target returns while aiming to provide monthly redemptions (subject to liquidity constraints, the underlying fund and the constitution).

Portfolio Construction

The PMP fund features strategic multi-layer structure balancing core institutional funds with opportunistic investments and liquidity reserves. This design ‘seeks to’ deliver sustainable 10-13% target returns whilst ‘aiming’ to maintain accessibility.

Loading legend...

Liquidity Portfolio

Provisioning and treasury function

- Uses of liquidity – collateral for FX hedging, working capital, redemptions, unfunded commitments

- Sources of liquidity – distributions, underlying redemptions, applications

Portfolio management

- Minimise ‘cash-drag’ – allocation to liquid credit provides returns closer to target asset class

Core (semi-liquid) Portfolio

- Core driver of returns – targeted 11-13% returns

- Broad diversification – implementation of relative value views with broadly diversified strategies

- Portfolio efficiency – ability to steer relative value views and rapidly deploy capital (open-ended funds)

Opportunistic Portfolio

- Return enhancement – 20% target return

- Diversification – access to companies, assets or investment strategies not able available in evergreen funds

- Long term thesis – alignment with long-term relative value views with short-term opportunity

How to invest

Via your financial adviser

Please reach out to your financial adviser for more information on Spire Capital Global Private Markets Portfolio.

Directly via Spire Capital

Resource Library