The case for US Multifamily Real Estate | Q4 2020

US Multifamily real estate – why now?

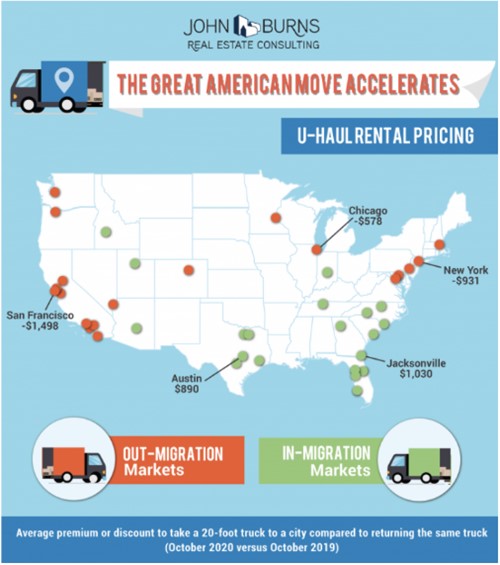

1. Demand– secular trends continue to support renting in the US (inc. mounting student-debt, aging population, immigration). Further, home prices have significantly outpaced incomes making buying a home simply unaffordable for many Americans. Meanwhile, select ‘high-growth’ US cities continue to grow faster than the US economy at large as people continue to migrate to affordable, low-tax, high job-growth sunbelt markets. This migration has been accelerated by C-19 with warmer climates and open-space highly desirable. These markets include Atlanta, Dallas, Phoenix, Charlotte, Nashville, Orlando et al. The suburbs of these cities offer renters an excellent affordability and value proposition

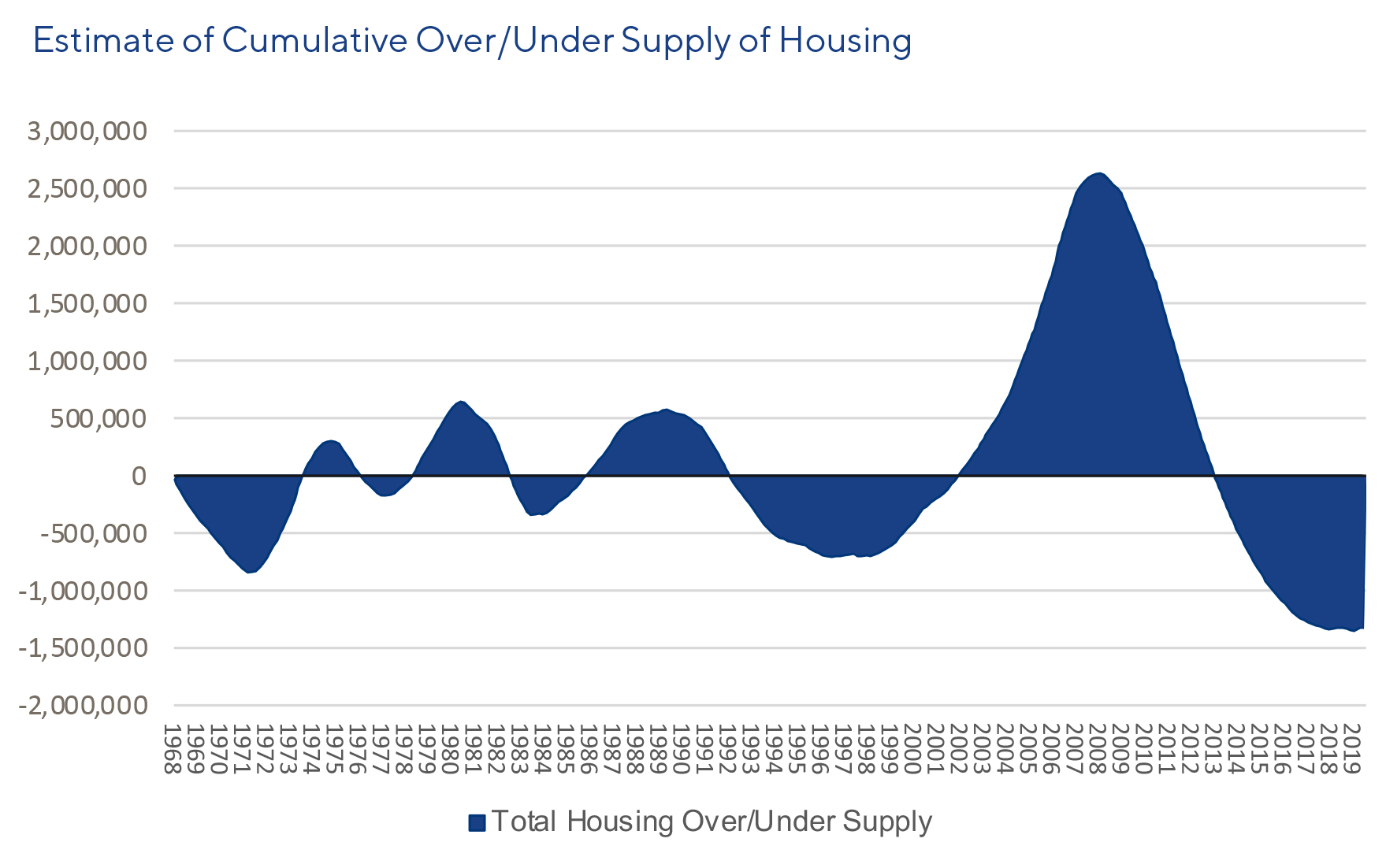

2. Supply– Freddie Mac estimates the shortfall of US housing supply at c.2.5m units. C-19 has worked to delay construction projects to further exacerbate the supply shortage. New supply has been concentrated in downtown ‘A product’ with developers in search of higher asking rents. Cortland’s target cities, sub-markets and product (i.e. B+ units in high-growth cities and suburban sub-markets) remain highly attractive given lack of supply and ability to drive rent growth

1 “The Major Challenges of Inadequate US Housing Supply”, Freddie Mac, December 2018. 2 Cortland estimate derived from trends in housing completions, population growth, prior to the National Homeownership Strategy

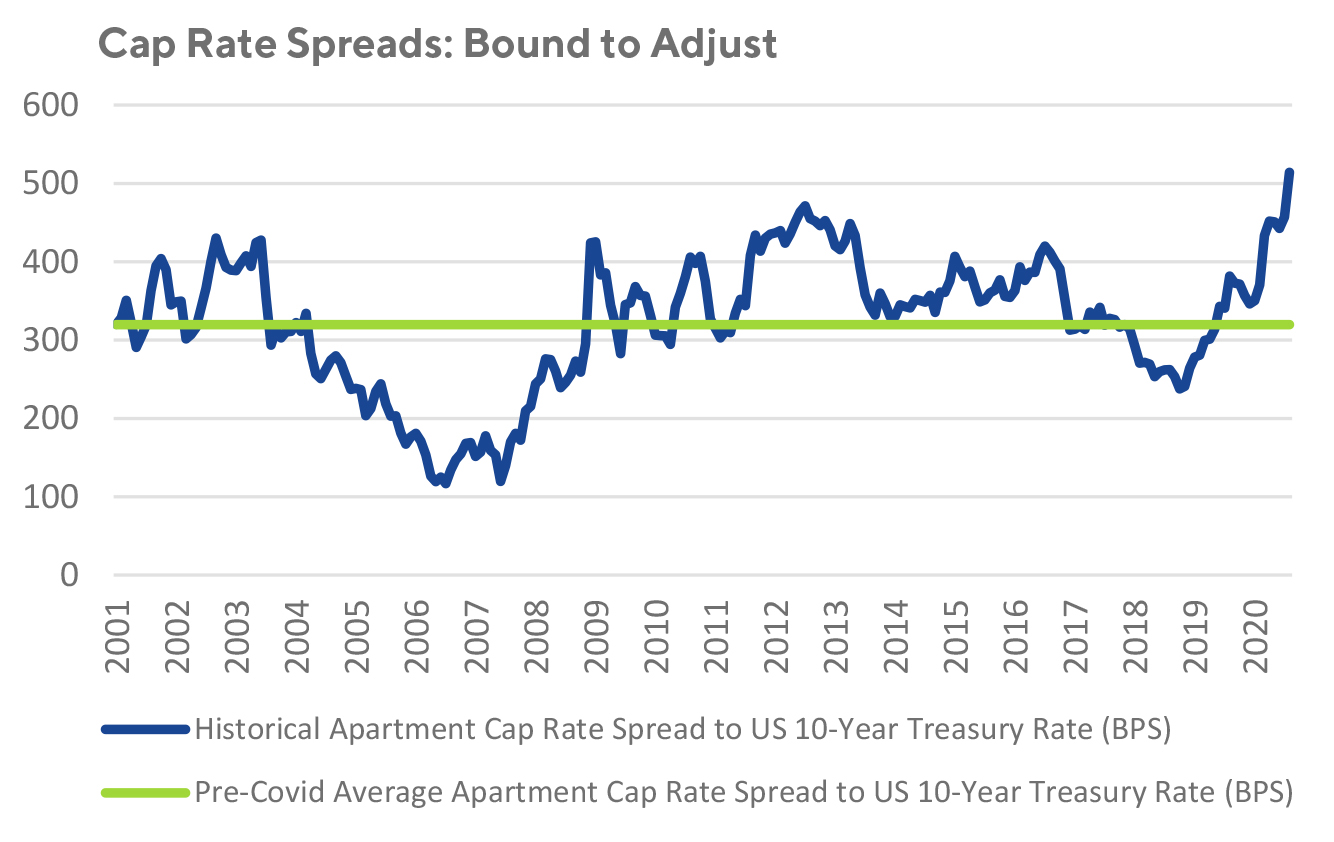

3. Pricing – cap rates indicate pricing has become highly attractive relative to risk free rate. Current multifamily cap rate spread is around 500bps vs long term average of 320. The spread tightened to 122 pre-GFC. In spite of a strong case for future cap rate compression, Cortland’s underwriting assumes cap rate expansion (i.e. market deterioration baked into expected returns) while still solving for mid-teens returns.

4. Resilience – US Multifamily occupancy has ranged from 92 to 95% over the last 20 years. Multifamily rent growth had a modest decline during GFC and was fastest to recover relative to other real estate types. Cortland’s rental growth is consistently 20% higher than the market (i.e. buffer). Rent collections across Cortland’s portfolio during C-19 have been in excess of 98% while occupancy has increased as high-quality affordable rental accommodation (USD 1500/mth) in low-density suburbs becomes more desirable. Cortland’s tenants average a rent to income ratio of 20% (i.e. highly affordable) while living in desirable (‘affordable luxury’) accommodation. Debt packages secured against multifamily assets are covenant lite and inexpensive – i.e. proxy for (low) risk – L+170bpts. Net Operating Income is underpinned by durable cashflows owing to hundreds of middle-class tenants per property.

5. Diversification – US Multifamily real estate introduces a new source of returns backed by highly resilient cash flows. Low correlation to public markets and traditional asset classes.

Why Cortland?

1. Scale and vertical integration – As of 30 June 2020, Cortland had USD 11.3bn in GAV across 185 assets comprising over 57k units in 16 high-growth metros/suburban markets including the US Southeast, Texas, and Colorado. Cortland is the largest multifamily owner/operator in key target markets of Atlanta and Dallas Fort Worth while being the 12th largest operator of multifamily real estate in the United States. Besides owning and operating the real estate, Cortland has developed a supply chain, via procurement from Asia, which imports substantial material through a high-volume manufacturing vendor pool. These materials are procured at a significantly lower cost compared to purchasing at wholesale and in bulk in the US (e.g sinks, taps, blinds, fixtures, cabinets, and others are obtained at a 40% to 65% discount to domestic prices, including transportation costs, and are comparable to premium brands found in newly developed communities).

2. Resident-centric operating model and brand – By focusing on the resident experience, Cortland continues to systematically drive rent growth, occupancy and tenant retention. Regional interior design teams focus on the amenity space, furnishings, and interior/exterior finishes by appealing to trends specific to each asset’s marketplace. Cortland’s Chief Experience Officer (ex Disney) leads the design and delivery of resident experience. A market leading approach to facilities management (85% of service requests completed in 24 hours), state-of-art fitness facilities/programs (‘Elevate by Cortland’) and self-service App (Cortland Plus) have all contributed to service excellence awards and Google rating of 4.34 vs 3.57 for market.

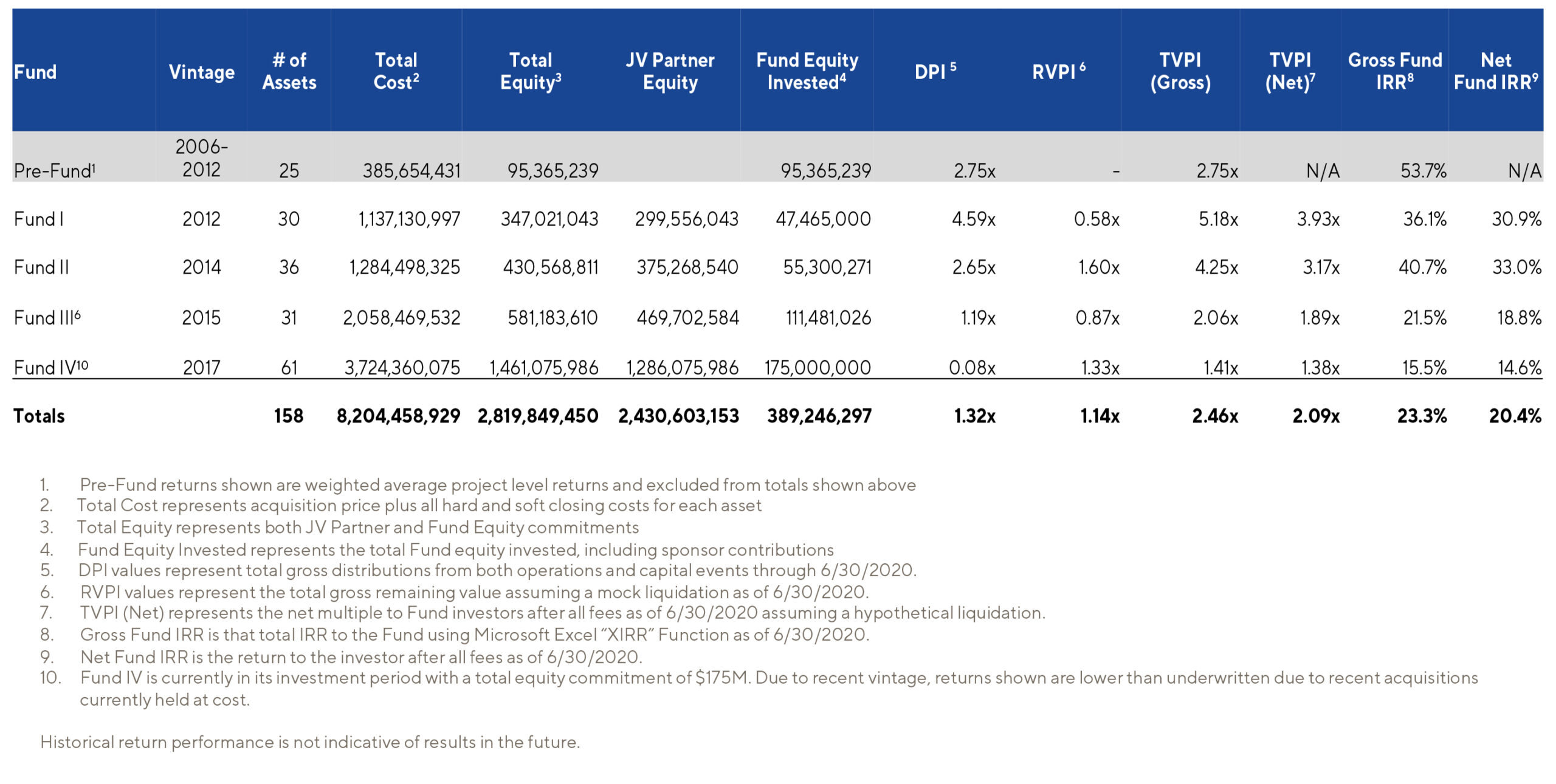

3. Track-record – below table shows Preqin data on Cortland predecessor funds (all 1st Quartile).

More information on the Spire Multifamily Value Fund I with Cortland is available here.